1 Global Narrow Fabric Weaving Machines Market Insight Analysis

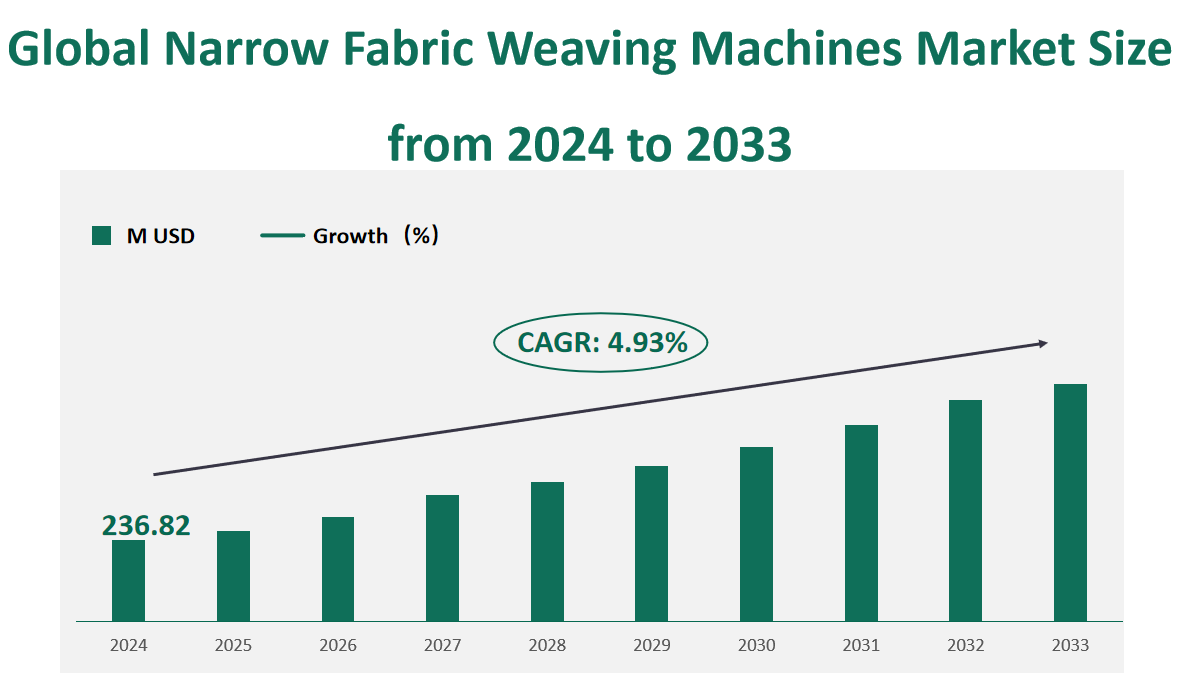

The global Narrow Fabric Weaving Machines Market will reach revenue of USD 236.82 million in 2024, with a CAGR of 4.93% during 2024-2033.

Narrow fabric is made by weaving, knitting, or plaiting fibers or yarns, with selvages on both sides to prevent the edges from unraveling. Narrow fabrics usually do not exceed a final width of 12 inches. Narrow fabric weaving machines can efficiently weave multiple narrow fabrics at the same time to meet their needs in a variety of textile weaving factories.

Figure Global Narrow Fabric Weaving Machines Market Size (M USD) and CAGR (2024-2033)

2 Narrow Fabric Weaving Machines Market Growth Drivers and Restraints

The integration of advanced technologies such as automation, digitalization, and sustainable features in textile machinery has improved efficiency and quality standards. These innovations have made production processes faster and more precise, enhancing the appeal of narrow fabric weaving machines.

Asia-Pacific, particularly China and India, has been a significant contributor to market growth due to the booming textile industry in these regions. The demand for textiles in these areas is driven by population growth, rising disposable income, and increasing demand for clothing and household goods.

Narrow fabrics are used in a variety of industries, including apparel, safety, automotive, aerospace, and medical. The diversification of applications has created new avenues for the market’s expansion, especially with the rise of technical textiles and smart fabrics.

However, the market faces challenges such as high initial capital expenditure for new machinery, maintenance, and operational costs. The textile machinery sector, especially the latest generation with automation and sustainable features, is typically expensive, which can hinder market growth. Furthermore, outdated machinery can lead to delivery delays, increased downtime, and safety accidents, posing significant limitations to the market. The need for more sustainable and eco-friendly production methods is a growing constraint that manufacturers must address to remain competitive.

3 Technological Innovations and Mergers in the Narrow Fabric Weaving Machines Market

One of the most significant technological innovations is the application of automation and digitalization in weaving machinery. These advancements have led to the development of smart looms that can operate with minimal human intervention, thereby increasing efficiency and reducing production costs. For example, machines with automatic weft insertion, electronic pattern control and integrated quality control systems are becoming more common.

Technological innovations have also led to high-speed narrow fabric looms that can produce fabrics at faster speeds without compromising on quality. This is especially important to meet the demand for fast turnaround times in fashion and other fast-paced industries.

With the growing focus on sustainability, there is a push to develop machines that minimize waste, reduce energy consumption and use environmentally friendly materials. Innovations such as waterless dyeing systems and machines that can recycle fabric waste are gaining traction.

The market is also witnessing the emergence of smart textiles, which require complex weaving techniques. Narrow fabric looms are being upgraded to incorporate technology that allows sensors and electronics to be integrated into the fabric.

Mergers and acquisitions have also played a role in shaping the market, with companies strategically acquiring smaller players to expand their product offerings and global reach. These activities have led to an intensified competitive landscape, with larger players consolidating their market positions and smaller players seeking innovative ways to stay competitive.

4 Global Narrow Fabric Weaving Machines Market Size by Type

Tape Line: 6 machines are designed for lighter applications, suitable for producing elastic and non-elastic narrow fabrics across all yarn qualities. In 2024, Tape Line: 6 is projected to generate a revenue of $33.85 million, holding a significant share in the market. The versatility and adaptability of these machines make them a popular choice for a wide range of applications, from technical textiles to garment accessories.

Tape Line: 8 machines are known for their ability to handle medium to heavy-duty fabrics, making them ideal for industrial applications such as slings and webbing. The revenue for Tape Line: 8 in 2024 is expected to reach $86.10 million, capturing a substantial market share. These machines are recognized for their robust construction and ability to produce high-quality, durable fabrics that can withstand heavy loads.

Designed for even heavier fabrics, Tape Line: 12 machines are the workhorses of the industry, capable of producing the thickest and most robust narrow fabrics. In 2024, the revenue for Tape Line: 12 is forecasted to be $72.62 million, reflecting a healthy market share. These machines are essential for applications that require extreme durability and strength, such as in the manufacturing of heavy-duty slings and industrial belts.

Table Global Narrow Fabric Weaving Machines Market Size and Share by Type in 2024

Type | Market Size (M USD) 2024 | Market Share 2024 |

|---|---|---|

Tape Line: 6 | 33.85 | 14.30% |

Tape Line: 8 | 86.10 | 36.36% |

Tape Line: 12 | 72.62 | 30.66% |

Others | 44.25 | 18.68% |

5 Global Narrow Fabric Weaving Machines Market Size by Application

In 2024, the market revenue for Tape is projected to reach $151.87 million, capturing a dominant share of the market. Tape applications are pervasive in the garment industry, where they are used for reinforcing seams, pockets, and buttonholes, as well as for creating waistbands, hems, and cuffs. They also serve as a decorative element, adding texture, color, and contrast to clothing items. The Ribbon segment is expected to generate $84.95 million, with applications often thought of as decorative but also crucial in creating larger fabrics through weaving, crocheting, or knitting.

Ribbons, ranging from 1/8 in to 1 ft in width, are classified by the textile industry as a narrow fabric and find use in various accessories such as belts, bags, and shoes. The market share for Tape is anticipated to be 64.13%, while Ribbon is expected to hold 35.87% of the market, reflecting the substantial demand for these applications in the textile industry.

Table Global Narrow Fabric Weaving Machines Market Size and Share by Application in 2024

Application | Market Size (M USD) 2024 | Market Share 2024 |

|---|---|---|

Tape | 151.87 | 64.13% |

Ribbon | 84.95 | 35.87% |

6 Global Narrow Fabric Weaving Machines Market Size by Region

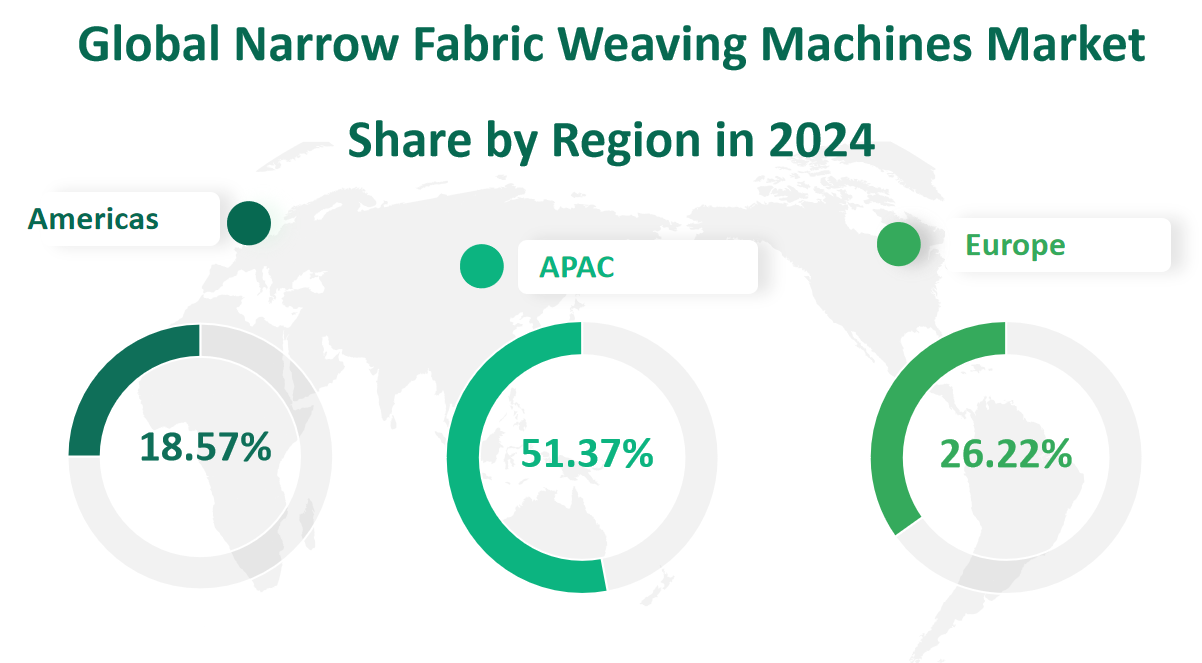

In 2024, the Asia-Pacific region (APAC) is forecasted to lead with a market revenue of $121.66 million, reflecting its significant role in the global textile industry. APAC, with its growing demand from key textile-producing countries like China and India, accounts for 51.37% of the global market share.

The Americas are expected to generate $43.97 million, holding 18.57% of the market share, with the United States being a key contributor due to its substantial textile industry.

Europe, with a market revenue of $62.10 million, is projected to have a 26.22% share, highlighting the region’s established textile sector and technological advancements in textile machinery.

The Middle East & Africa are expected to contribute $9.09 million, with a market share of 3.84%, indicating a growing demand for narrow fabric weaving machines in these regions.

Figure Global Narrow Fabric Weaving Machines Market Size (M USD) by Region in 2024

7 Global Narrow Fabric Weaving Machines Market Analysis by Major Players

7.1 Jakob Müller

Company Introduction and Business Overview:

Jakob Müller, established in 1887 and headquartered in Switzerland, operates globally. The company is renowned for its technological advancements in the ribbon and narrow fabric industry.

Jakob Müller specializes in providing a range of products and applications, including Narrow Fabric Weaving Systems, Rope Weaving Systems, Warp Crochet Knitting Systems, Label Production Systems, and Textile Printing Systems. Their focus on innovation and quality has solidified their position as a market leader.

Products:

The NFM® Narrow Fabric Loom is designed for light to medium-weight elastic and non-elastic narrow fabrics. It features a modular design, fully electronic drives, and a modern control platform MÜDATA® M, offering high performance and operational safety.

Market Performance in 2024:

Jakob Müller is projected to achieve a revenue of $68.99 million with a gross margin of 32.47%. Their sale volume is expected to be 4,756 units, maintaining their position as a top player in the market.

7.2 Kyang Yhe

Company Introduction and Business Overview:

Kyang Yhe, founded in 1964 and based in China, has a global sales reach. The company is a prominent manufacturer in the high-speed needle loom machine sector.

Combining research and development with production and sales, Kyang Yhe offers a variety of textile machinery, including high-speed needle loom machines, narrow fabric jacquard loom machines, and heavy narrow fabric needle loom machines, among others.

Products:

Their Heavy Narrow Fabric Loom Series is designed for industrial applications, producing mid-heavy or heavy-duty slings with a weaving width within 370mm and the ability to weave up to 8mm thick.

Market Performance in 2024:

Kyang Yhe is expected to generate a revenue of $23.51 million with a gross margin of 29.14%. The company’s sale volume is projected to be 1,682 units.

7.3 DKY

Company Introduction and Business Overview:

DKY Machinery Co., Ltd., established in 1987 and headquartered in China, has a significant presence in Asia, Europe, Middle South America, and Africa.

DKY is specialized in manufacturing high-speed narrow fabric needle loom machines. They are committed to integrity and customer-first business philosophies, earning a reputable status in the global market.

Products:

The DHJm 8/45/384 Computerized Narrow Fabric Jacquard Loom is a key product, mainly used to produce elastic and non-elastic jacquard belts, widely used in belts, sports shoes, bags, pet belts, etc.

Market Performance in 2024:

DKY is projected to achieve a revenue of $15.48 million with a gross margin of 26.59%. The company’s sale volume is expected to be 1,254 units.