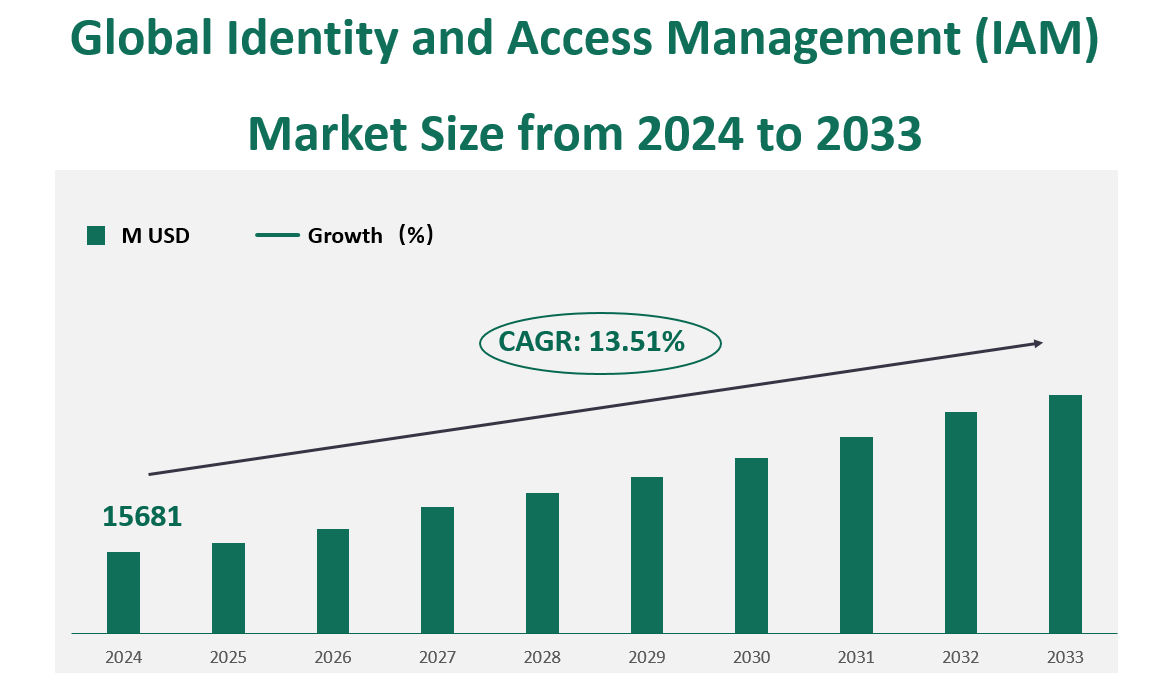

1 Global Identity and Access Management (IAM) Market Size (Revenue) and CAGR (2024-2033)

The global Identity and Access Management (IAM) market, which stood at a value of 15681 million USD in 2024, is anticipated to experience a Compound Annual Growth Rate (CAGR) of 13.51% from 2024 to 2033. IAM is a critical framework for businesses, simplifying the management of electronic identities by automating the capture, recording, management, and initiation of user identities and their respective permissions. This technology not only enhances security profiles but also facilitates easy access, increases productivity, improves user experience, and reduces overall IT costs. IAM platforms are designed to ensure that on-premises, cloud, and hybrid systems provide the proper access to the right roles and individuals at the right time, with a significant impact of GDPR leading to the use of the term Customer Identity and Access Management (CIAM).

The IAM market is segmented by type into Cloud and On-Premise, with Cloud IAM solutions expected to dominate due to their scalability and flexibility. The market is also segmented by application across various industries including BFSI, Telecom and IT, Retail and Consumer Packed Goods, Government, Energy Utilities, Education, Manufacturing, Healthcare and Life Sciences, and others. Each segment is driven by the need for secure and efficient management of user identities and access permissions, with the BFSI sector leading the pack due to the sensitive nature of financial data and the strict regulatory requirements.

Figure Global Identity and Access Management (IAM) Market Size (M USD) Outlook (2024-2033)

2 Identity and Access Management (IAM) Industry Trends and Growth Drivers

Table Key Industry Trends of Identity and Access Management (IAM)

Item | Descriptions |

|

|

|

|

Table Key Market Drivers & Growth Opportunities of Identity and Access Management (IAM)

Descriptions | |

|

|

|

|

3 Global Identity and Access Management (IAM) Revenue Share by Type in 2024

Cloud IAM solutions, which offer scalability and flexibility, are expected to dominate the market in 2024, with a significant market share due to their ability to meet the growing demand for remote access and digital transformation initiatives. Cloud IAM solutions reached a value share of 51.50% in 2024, reflecting a substantial growth from previous years. This product type is favored for its ability to provide identity services over the internet, reducing the need for on-site infrastructure and maintenance.

On-Premise IAM solutions, while still holding a significant share, are expected to face competition from Cloud-based solutions. However, they remain critical for organizations with specific security requirements that prefer local data control. On-Premise IAM reached a value share of 48.50% in 2024. These solutions are tailored for organizations that require complete control over their identity data and prefer to manage their IAM infrastructure in-house.

Figure Global Identity and Access Management (IAM) Revenue Market Share by Type in 2024

| 2024 |

Cloud | 51.50% |

On-Premise | 48.50% |

Total | 100.00% |

4 Global Identity and Access Management (IAM) Revenue Share by Application in 2024

The IAM market is segmented into various applications, each with its own unique requirements and market dynamics. In 2024, the global IAM market is valued at 15681 million USD, with applications playing a significant role in the market’s growth.

BFSI (Banking, Financial Services, and Insurance) continues to be the largest application market, with a value share of 30.25% in 2024. This sector’s demand for secure identity management is driven by the need to protect sensitive financial data and comply with stringent regulatory requirements.

Telecom and IT with a market value share of 9.00% in 2024. This application’s growth is attributed to the rapid digital transformation in the telecom and IT sectors, which requires robust IAM solutions to secure access to critical infrastructure and services.

Retail and Consumer Packed Goods is another significant application, with a market value share of 15.00% in 2024. The growth in this segment is driven by the need to protect customer data and provide seamless customer experiences across various touchpoints.

Table Global Identity and Access Management (IAM) Revenue Market Share by Application in 2024

| 2024 |

BFSI | 30.25% |

Telecom and IT | 9.00% |

Retail and Consumer Packed Goods | 15.00% |

Government | 8.91% |

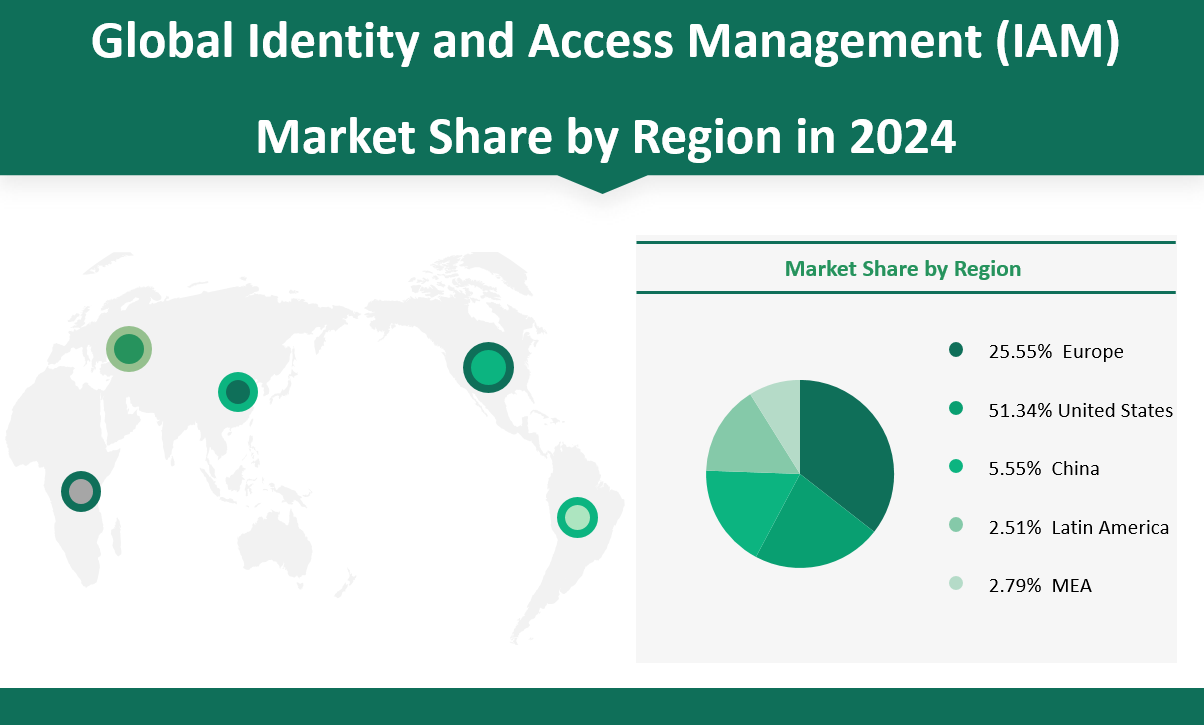

5 Global Identity and Access Management (IAM) Market Revenue Share by Region in 2024

United States is expected to be the largest regional market by revenue, with a value share of 51.34% in 2024. This region’s dominance is attributed to the presence of major IAM vendors, advanced technology infrastructure, and a strong focus on cybersecurity.

Europe follows with a market value share of 25.55% in 2024. The region’s growth is driven by the increasing adoption of digital services and the need to comply with data protection regulations such as GDPR.

China is anticipated to be the fastest-growing region. China has a market value share of 5.55% in 2024. This growth is fueled by the rapid digital transformation in China, which is investing heavily in cybersecurity solutions to protect against increasing cyber threats.

In conclusion, the IAM market is a dynamic and growing industry, with product types, applications, and regions each playing a significant role in shaping its trajectory. Cloud IAM solutions are leading in terms of market share and growth rate, while the BFSI sector and the China region are driving the market’s expansion in their respective categories. As the demand for secure identity management solutions continues to rise, the IAM market is set to experience significant growth in the coming years.

Figure Global Identity and Access Management (IAM) Market Revenue Share by Region in 2024

6 Global Identity and Access Management (IAM) Revenue Market Share by Major Players in 2024

The top three companies in the global Identity and Access Management (IAM) market in 2024 are mainly Okta, Microsoft Corporation and IBM Corporation. Among them, Okta ranks first with a market share of 16.50%, Microsoft Corporation ranks second with a market share of 14.45%, and IBM Corporation ranks third with a market share of 6.11%.

Okta, established in 2009 and headquartered in San Francisco, USA, is a leading provider of cloud-based IAM solutions. The company specializes in offering identity solutions that enable secure access to applications, data, and devices for businesses of all sizes. Okta’s platform is designed to simplify and secure user authentication and authorization processes, providing a seamless user experience across various applications and devices.

Microsoft Corporation ranks second with a market share of 14.45%. Microsoft Corporation, founded in 1975 and based in Redmond, Washington, USA, is a global technology giant with a diverse product portfolio. Microsoft’s IAM solutions are part of its broader security and identity offerings, which are designed to help organizations manage and secure access to their resources across various platforms and environments.

IBM Corporation ranks third with a market share of 6.11%. IBM Corporation, established in 1911 and headquartered in Armonk, New York, USA, is a multinational technology company known for its wide range of IT solutions and services. IBM’s IAM solutions are part of its cybersecurity portfolio, which aims to provide comprehensive security measures for businesses.

Table Global Identity and Access Management (IAM) Revenue Market Share by Major Players in 2024

| 2024 |

16.50% | |

14.45% | |

6.11% |