1 Global Optical Material Synthetic Diamond Market Outlook

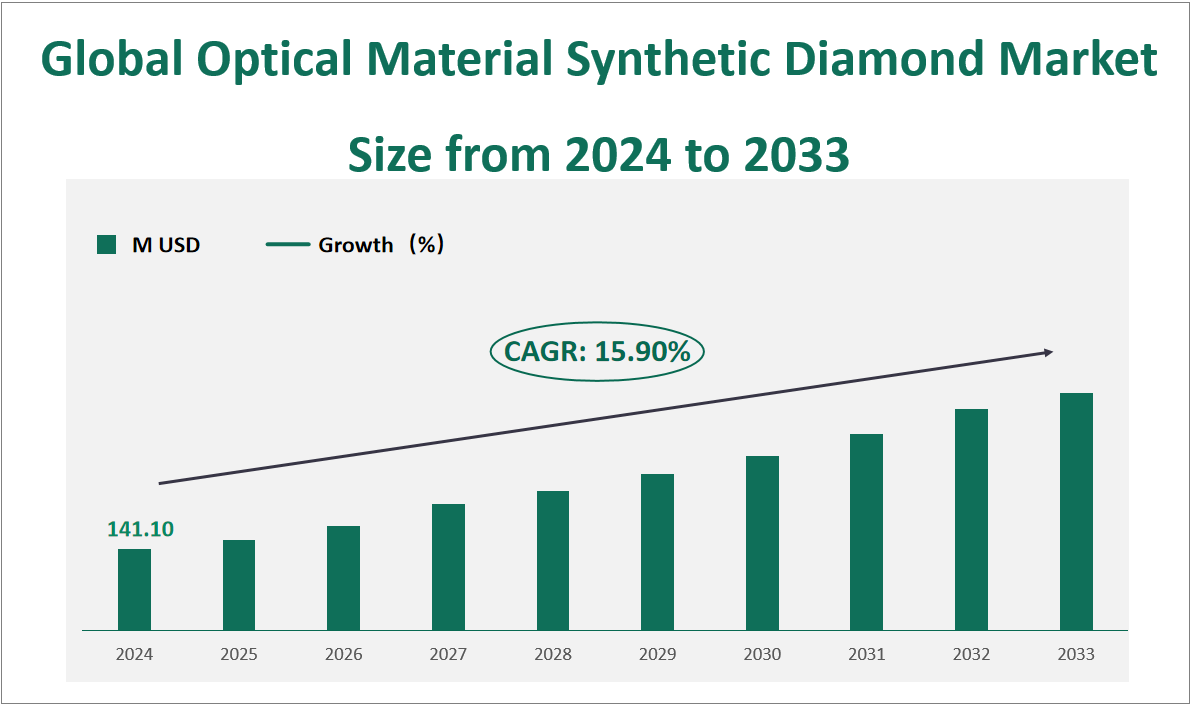

The global Optical Material Synthetic Diamond market is projected to exhibit substantial growth in the coming years, with a CAGR of 15.90% from 2024 to 2033, reaching a total market size of $141.10 million USD in 2024. Optical Material Synthetic Diamond refers to diamonds produced through advanced techniques such as Chemical Vapor Deposition (CVD). These synthetic diamonds share most of the basic properties with natural diamonds, including extremely high hardness, high thermal conductivity, and high electrical resistivity. They are widely used in optical applications due to their superior performance and versatility. Synthetic diamonds can be tailored to meet specific requirements, making them ideal for applications such as X-ray windows, ATR units, lenses, and infrared windows. Their high spectral passability and thermal stability make them a preferred choice for high-energy laser systems and other demanding optical applications.

Figure Global Optical Material Synthetic Diamond Market Size and Growth Rate (2024-2033)

2 Optical Material Synthetic Diamond Market Growth Drivers and Constraints

The growth of the Optical Material Synthetic Diamond market is driven by several key factors. Firstly, the increasing demand for high-performance optical instruments in industries such as aerospace, defense, and healthcare is a significant driver. Synthetic diamonds offer unparalleled advantages in terms of durability, thermal conductivity, and optical clarity, making them essential for advanced optical systems. Secondly, technological advancements in CVD and other diamond synthesis methods have improved the quality and affordability of synthetic diamonds, further expanding their market potential.

However, the market also faces several challenges. One of the primary limiting factors is the high technical barrier associated with the production of high-quality synthetic diamonds. The CVD process requires precise control of temperature, pressure, and gas mixtures, which can be challenging to achieve consistently. Additionally, the supply of high-quality CVD equipment is limited, which can restrict the expansion of production capacities. The market is also affected by regulatory and environmental concerns, as the production of synthetic diamonds requires significant energy inputs and can generate environmental impacts.

3 Optical Material Synthetic Diamond Market Innovations and M&A Activities

Technological innovation is a cornerstone of the Optical Material Synthetic Diamond market. Advances in CVD technology have enabled the production of larger and higher-quality synthetic diamonds, which are increasingly being used in advanced optical applications. Companies such as Sumitomo Electric, Element Six, and ZS-TECH are at the forefront of this innovation, continuously improving their production processes and product offerings.

Corporate mergers and acquisitions are also shaping the market landscape. For instance, WD Lab Grown Diamonds’ acquisition of J2 Materials in 2021 expanded its capabilities in crystal growth technology, enhancing its position in the market. These strategic moves are aimed at consolidating market share, improving technological capabilities, and expanding into new applications and regions.

In conclusion, the global Optical Material Synthetic Diamond market is poised for significant growth, driven by increasing demand for high-performance optical materials and technological advancements. While challenges such as technical barriers and supply constraints exist, ongoing innovation and strategic corporate activities are expected to drive the market forward. Companies that can effectively navigate these dynamics will be well-positioned to capture a larger share of this growing market.

4 Global Optical Material Synthetic Diamond Market Analysis by Type

In 2024, the global Optical Material Synthetic Diamond market is forecasted to achieve a total revenue of $141.1 million USD. Specifically, the revenue breakdown by type is as follows:

MPCVD (Microwave Plasma Chemical Vapor Deposition): $103.22 million USD, accounting for 73.15% of the total market revenue.

HFCVD (Hot Filament Chemical Vapor Deposition): $37.88 million USD, representing 26.85% of the total market revenue.

These figures highlight the continued dominance of MPCVD in the market, driven by its superior performance and broader application scope in high-end optical materials.

Table Global Optical Material Synthetic Diamond Market Size and Share by Type in 2024

|

Type |

Market Size in 2024 (M USD) |

Market Share in 2024 (%) |

|---|---|---|

|

MPCVD |

103.22 |

73.15% |

|

HFCVD |

37.88 |

26.85% |

5 Global Optical Material Synthetic Diamond Market Analysis by Application

In 2024, the global Optical Material Synthetic Diamond market is projected to generate a total revenue of $141.1 million USD. The revenue distribution across different applications is as follows:

X-ray windows: $38.56 million USD, representing 27.33% of the total market revenue.

ATR units: $19.84 million USD, accounting for 14.06% of the total market revenue.

Lenses: $29.73 million USD, making up 21.07% of the total market revenue.

Infrared windows: $35.60 million USD, holding 25.23% of the total market revenue.

Others: $17.37 million USD, contributing 12.31% of the total market revenue.

These figures highlight the significant contributions of infrared windows and lenses to the market revenue, reflecting their widespread use in various optical applications.

Table Global Optical Material Synthetic Diamond Market Size and Share by Application in 2024

|

Application |

Market Size in 2024 (M USD) |

Market Share in 2024 (%) |

|---|---|---|

|

X-ray windows |

38.56 |

27.33% |

|

ATR units |

19.84 |

14.06% |

|

lenses |

29.73 |

21.07% |

|

Infrared windows |

35.60 |

25.23% |

|

Others |

17.37 |

12.31% |

6 Global Optical Material Synthetic Diamond Market Analysis by Region

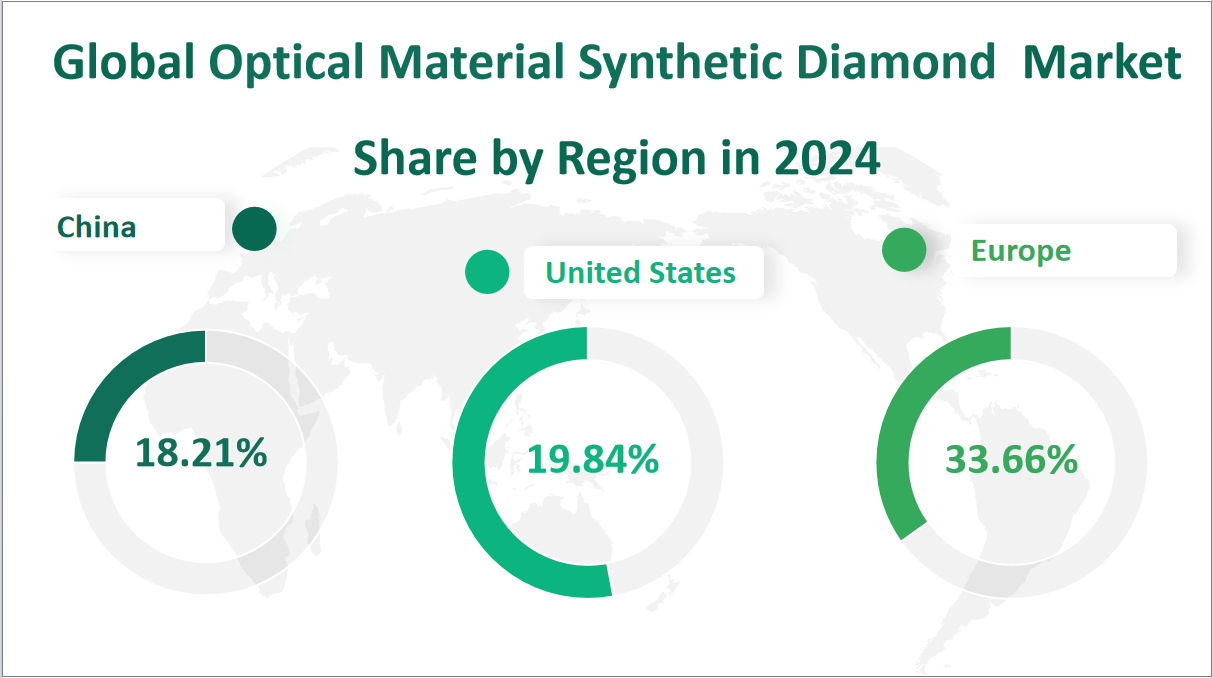

In 2024, the global Optical Material Synthetic Diamond market is expected to reach a total revenue of $141.1 million USD, with the revenue distribution by region as follows:

United States: $28 million USD, accounting for 19.84% of the total market revenue.

Europe: $47.5 million USD, representing 33.66% of the total market revenue.

China: $25.69 million USD, holding 18.21% of the total market revenue.

Japan: $14.17 million USD, contributing 10.04% to the total market revenue.

India: $9.62 million USD, making up 6.82% of the total market revenue.

Southeast Asia: $5.78 million USD, accounting for 4.10%.

Latin America: $4.63 million USD, representing 3.28%.

Middle East and Africa: $1.65 million USD, holding 1.17%.

These figures indicate that Europe is expected to be the largest market for Optical Material Synthetic Diamonds in 2024, followed closely by the United States, highlighting the regional demand dynamics in the industry.

Figure Global Optical Material Synthetic Diamond Market Share by Region in 2024

7 Top 3 Companies of Global Optical Material Synthetic Diamond Market

7.1 Sumitomo Electric

Company Introduction and Business Overview:

Sumitomo Electric is a global leader in the production of synthetic diamonds for optical materials. Established in 1897 in Osaka, Japan, Sumitomo Electric has a diverse business portfolio spanning automotive, information communications, electronics, energy & environment, and industrial materials. The company’s extensive experience and technological prowess have positioned it as a pioneer in the development and commercialization of synthetic diamond products.

Products Offered:

Sumitomo Electric specializes in Chemical Vapor Deposition (CVD) diamonds, which are used in a variety of optical applications. Their products include high-quality diamond heat sinks, optical-grade CVD diamond films, and single-crystal diamonds tailored for specific applications such as X-ray windows, infrared optics, and high-power laser systems. These products leverage the exceptional thermal conductivity, hardness, and optical transparency of synthetic diamonds.

Sales Revenue in the Latest Year:

Sumitomo Electric’s revenue from Optical Material Synthetic Diamond was $29.76 million USD. This significant revenue underscores the company’s strong market position and its ability to meet the growing demand for high-performance optical materials. Sumitomo Electric’s continuous investment in R&D and production capabilities ensures that it remains at the forefront of technological advancements in the synthetic diamond industry.

7.2 ZS-TECH

Company Introduction and Business Overview:

ZS-TECH is a multinational high-tech enterprise headquartered in Shanghai, China. Established in 2014, ZS-TECH has rapidly grown to become a significant player in the synthetic diamond market. The company focuses on the research, development, and production of CVD diamonds, leveraging advanced technologies to produce high-quality synthetic diamonds for various applications.

Products Offered:

ZS-TECH offers a range of optical-grade CVD single-crystal diamonds, which are ideal for applications requiring high hardness, thermal stability, and optical clarity. Their products are used in high-power laser systems, infrared windows, and other demanding optical applications. ZS-TECH’s commitment to innovation and quality has enabled it to develop products that meet the stringent requirements of the global market.

Sales Revenue in the Latest Year:

ZS-TECH’s revenue from Optical Material Synthetic Diamond was $14.21 million USD. This revenue reflects the company’s growing market share and its ability to compete with established players in the industry. ZS-TECH’s strategic focus on expanding its product portfolio and enhancing production capabilities has positioned it well for future growth.

7.3 Element Six

Company Introduction and Business Overview:

Element Six is a global leader in the design, development, and production of synthetic diamond and tungsten carbide metamaterials. Established in 1946, Element Six is part of the De Beers Group and operates manufacturing facilities in the UK, Ireland, Germany, South Africa, and the United States. The company is renowned for its innovative synthetic diamond solutions, which are used in a variety of industrial and optical applications.

Products Offered:

Element Six offers a wide range of CVD diamond products, including optical-grade diamond films, single-crystal diamonds, and high-performance diamond heat sinks. These products are used in applications such as high-power laser systems, infrared spectroscopy, and other advanced optical technologies. Element Six’s commitment to innovation ensures that its products meet the highest standards of quality and performance.

Sales Revenue in the Latest Year:

Element Six’s revenue from Optical Material Synthetic Diamond was $9.64 million USD. This revenue highlights the company’s strong market presence and its ability to deliver high-quality synthetic diamond solutions. Element Six’s continuous investment in R&D and production technology ensures that it remains a key player in the global synthetic diamond market.