1 Global Bulk Salt Market Outlook

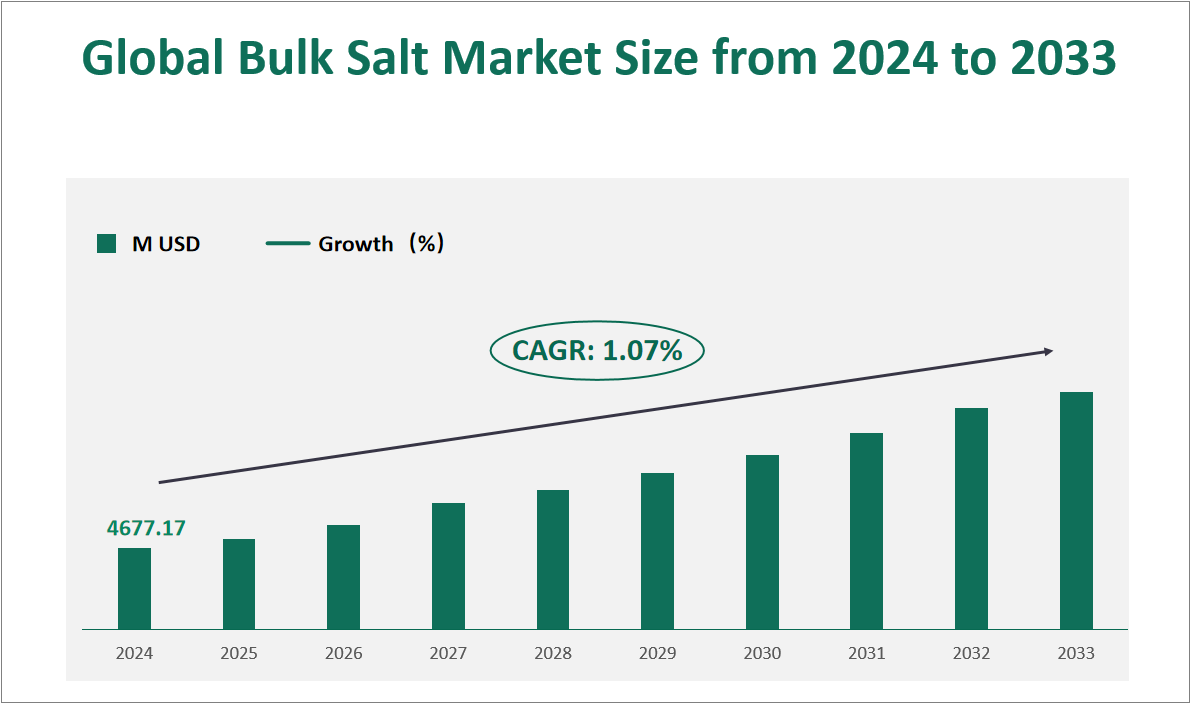

The global Bulk Salt market is projected to exhibit substantial growth in the coming years, with a CAGR of 1.07% from 2024 to 2033, reaching a total market size of $4677.17 million USD in 2024. Bulk salt refers to large quantities of salt, primarily used in industrial processes rather than for direct consumption. It is categorized into three main types: rock salt, solar salt, and evaporated salt. Rock salt is mined from underground deposits, solar salt is produced through the evaporation of seawater or brine, and evaporated salt is manufactured by evaporating water from brine solutions. These types of salt are widely used in chemical manufacturing, de-icing roads and pathways, general industrial processes, agriculture, and water treatment. The versatility of bulk salt makes it an indispensable commodity in modern industrial economies.

Figure Global Bulk Salt Market Size and Growth Rate (2024-2033)

2 Bulk Salt Market Growth Drivers and Constraints

The growth of the global bulk salt market is influenced by several driving factors. One of the primary drivers is the increasing demand in the de-icing sector. In regions with cold climates, such as North America and Europe, bulk salt is essential for maintaining transportation infrastructure by preventing ice formation on roads, sidewalks, and parking lots. The use of bulk salt in de-icing applications is expected to continue growing as urbanization expands and winter maintenance becomes more critical.

Another significant driver is the demand from the Asia-Pacific region, particularly in countries with developing economies. The agricultural productivity in this region creates a substantial market for bulk salt, which is used to enhance the quality of sodium-loving crops. Additionally, the chemical industry’s reliance on bulk salt for the production of sodium bicarbonate, sodium hydroxide, and other chemicals further supports market growth.

However, the bulk salt market also faces several limiting factors. One of the primary challenges is the high capital barriers for new entrants. The initial investment required for large-scale salt production equipment and the need for abundant raw material reserves pose significant hurdles. Additionally, environmental regulations are becoming stricter, increasing the cost of compliance for salt producers. The production of bulk salt can lead to environmental pollution, and companies must invest in advanced technologies to meet emission standards.

3 Bulk Salt Market Innovations and M&A Activities

The bulk salt market has seen several technological innovations and corporate activities that shape its future. Technological advancements in salt production have led to more efficient mining and processing methods. For example, companies like Cargill and Compass Minerals have invested in modernizing their production facilities to increase output and reduce costs. These innovations not only improve the quality of bulk salt but also enhance its environmental sustainability.

Corporate mergers and acquisitions have also played a significant role in shaping the market. For instance, K+S AG’s acquisition of Morton Salt has positioned it as a global leader in salt production. Similarly, Nobian’s divestment of its Salt Specialties business to Salins Group has allowed it to focus on its core chemical production while expanding Salins Group’s market reach. These strategic moves consolidate market power and enhance the competitiveness of the companies involved.

In conclusion, the global bulk salt market is poised for steady growth, driven by increasing demand from key industries and regions. However, it must navigate challenges related to environmental regulations and high entry barriers. Technological innovation and strategic corporate activities will be crucial in determining the market’s future trajectory.

4 Global Bulk Salt Market Analysis by Type

In 2024, the global bulk salt market is forecasted to see a total sales volume of 140,272 thousand tons. Among the different types of bulk salt, rock salt is expected to dominate with sales reaching 93,071 thousand tons, accounting for 66.35% of the total market share. Solar salt is projected to have sales of 31,230 thousand tons, representing 22.26% of the market. Evaporated salt is anticipated to reach sales of 15,971 thousand tons, holding 11.39% of the market share. These figures highlight the continued dominance of rock salt in the global bulk salt market, while solar and evaporated salts also maintain significant shares.

Table Global Bulk Salt Sales and Share by Type in 2024

Type | Sales in 2024 (K Tons) | Market Share in 2024 (%) |

|---|---|---|

Rock Salt | 93071 | 66.35% |

Solar Salt | 31230 | 22.26% |

Evaporated Salt | 15971 | 11.39% |

5 Global Bulk Salt Market Analysis by Application

In 2024, the global bulk salt market is projected to have a total sales volume of 140,272 thousand tons across various applications. The chemical industry is expected to be the largest consumer, with sales reaching 65,514 thousand tons, representing 46.71% of the market share. The de-icing sector will account for 28,132 thousand tons, or 20.06% of the market, reflecting its significant role in winter maintenance. General industrial applications are forecasted to consume 24,101 thousand tons, holding a 17.18% market share. Agricultural use will reach 5,864 thousand tons, accounting for 4.18% of the market, while water treatment applications will utilize 5,572 thousand tons, or 3.97% of the total. Lastly, other applications are expected to account for 11,089 thousand tons, representing 7.91% of the market. This distribution underscores the diverse applications of bulk salt, with the chemical industry remaining the primary driver of demand.

Table Global Bulk Salt Sales and Share by Application in 2024

Application | Sales in 2024 (K Tons) | Market Share in 2024 (%) |

|---|---|---|

Chemical | 65514 | 46.71% |

De-Icing | 28132 | 20.06% |

General Industrial | 24101 | 17.18% |

Agricultural | 5864 | 4.18% |

Water Treatment | 5572 | 3.97% |

Others | 11089 | 7.91% |

6 Global Bulk Salt Market Analysis by Region

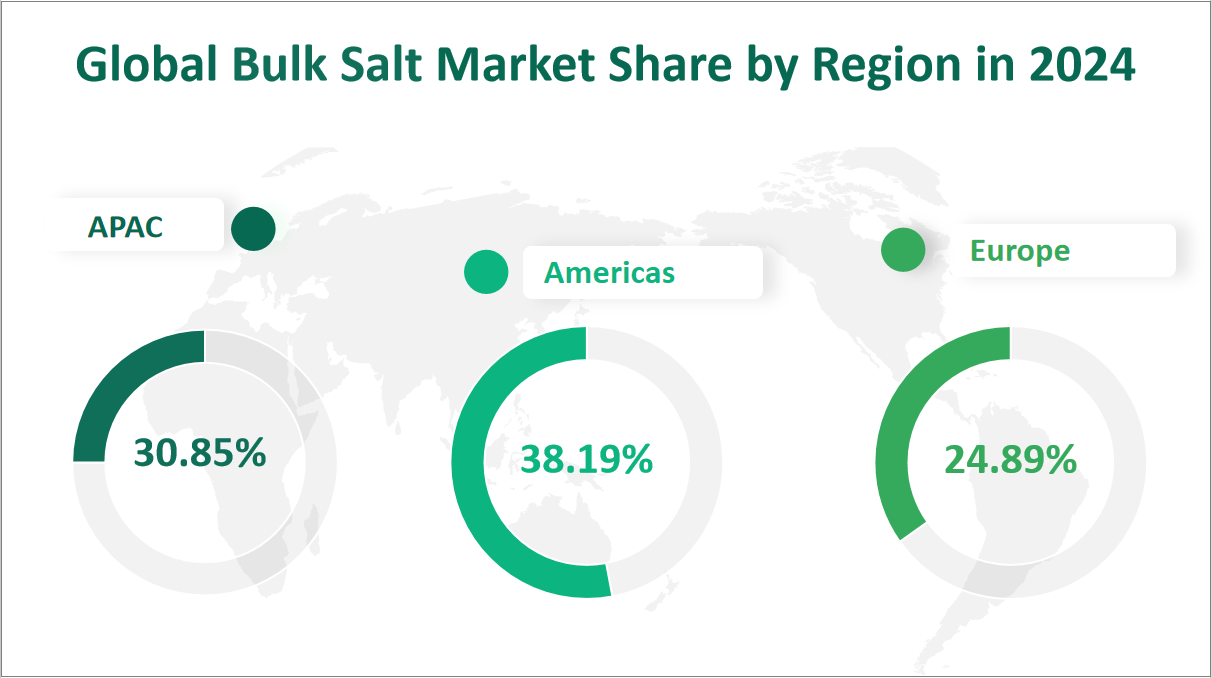

In 2024, the global bulk salt market is forecasted to generate a total revenue of 4,677.17 million US dollars across all regions. The Americas are expected to contribute 1,786.14 million US dollars, representing 38.19% of the global market share. Europe will account for 1,164.31 million US dollars, or 24.89% of the total revenue. The Asia-Pacific region is projected to generate 1,442.94 million US dollars, holding a 30.85% market share. Finally, the Middle East & Africa region will contribute 283.78 million US dollars, accounting for 6.07% of the global revenue. This distribution highlights the continued importance of the Americas and Asia-Pacific regions in driving the global bulk salt market’s economic value.

Figure Global Bulk Salt Market Share by Region in 2024

7 Top 3 Companies of Global Bulk Salt Market

7.1 Compass Minerals

Company Introduction and Business Overview:

Compass Minerals is a leading producer of essential minerals, including salt, magnesium chloride, sulfate of potash, and other plant nutrition products. Established in 1844, the company operates across the United States, Canada, Brazil, and the United Kingdom, with its headquarters in Overland Park, Kansas. Compass Minerals is renowned for its bulk highway deicing salt, which is widely used in North America and the UK. The company also offers consumer de-icing and water conditioning products, culinary salt, and other mineral-based products for agricultural and industrial applications.

Products Offered:

Compass Minerals’ flagship product is its bulk highway deicing salt, which is highly effective in melting ice and snow on roads and highways. This product is known for its cost-effectiveness and reliability, making it a preferred choice for winter maintenance programs. In addition to deicing salt, the company also offers a range of consumer and commercial products, including culinary salt, water softening salts, and specialty minerals for agricultural use.

Sales Revenue in the Latest Year:

Compass Minerals reported sales of 9,691 thousand tons of bulk salt, generating a revenue of 540.59 million US dollars. The company’s gross margin stood at 30.40%, reflecting its strong market position and efficient operations. Compass Minerals’ continued focus on product innovation and market expansion has enabled it to maintain a robust financial performance despite market fluctuations.

7.2 K+S AG

Company Introduction and Business Overview:

K+S AG is a German chemical company and one of the world’s largest producers of potash and salt. Established in 1889, K+S AG is headquartered in Kassel, Germany. The company’s operations span across Europe and North America, with a significant presence in the fertilizer and salt industries. K+S AG is known for its high-purity industrial rock salt, which is widely used in various chemical processes. The company’s acquisition of Morton Salt further solidified its position as a global leader in salt production.

Products Offered:

K+S AG offers a range of bulk salt products, including industrial rock salt, which is characterized by its high purity (typically 99%) and wide range of grain sizes. The company’s products are used in various applications, such as chemical manufacturing, de-icing, and water treatment. K+S AG’s commitment to quality and sustainability ensures that its products meet the highest industry standards.

Sales Revenue in the Latest Year:

K+S AG reported sales of 6,611 thousand tons of bulk salt, generating a revenue of 340.41 million US dollars. The company’s gross margin was 32.40%, highlighting its strong profitability and efficient production processes. K+S AG’s strategic acquisitions and focus on product diversification have enabled it to maintain a competitive edge in the global bulk salt market.

7.3 Nobian

Company Introduction and Business Overview:

Nobian is a leading European producer of essential chemicals, including high-purity salt, chlor-alkali, and chloromethanes. Established in 1918, Nobian operates in the Netherlands, Germany, and Denmark, with a strong presence in the European market. The company is known for its integrated value chain and modern production facilities, which enable it to supply high-quality products reliably and sustainably. Nobian’s commitment to safety and environmental responsibility sets it apart in the industry.

Products Offered:

Nobian offers a range of bulk salt products, including road salt, which is known for its purity and effectiveness in de-icing applications. The company’s road salt is designed to provide faster thawing effects compared to coarser salts, making it an ideal solution for winter road maintenance. Nobian’s product portfolio also includes specialty salts for industrial and agricultural use, reflecting its diverse market reach.

Sales Revenue in the Latest Year:

Nobian reported sales of 4,989 thousand tons of bulk salt, generating a revenue of 325.54 million US dollars. The company’s gross margin was 30.29%, demonstrating its strong financial performance and market position. Nobian’s focus on product quality and customer service has enabled it to maintain a robust market presence despite increasing competition.